See This Report on Pvm Accounting

Table of Contents9 Simple Techniques For Pvm AccountingThe 30-Second Trick For Pvm AccountingAn Unbiased View of Pvm AccountingPvm Accounting Can Be Fun For EveryoneThe Basic Principles Of Pvm Accounting Some Known Incorrect Statements About Pvm Accounting The Definitive Guide to Pvm Accounting

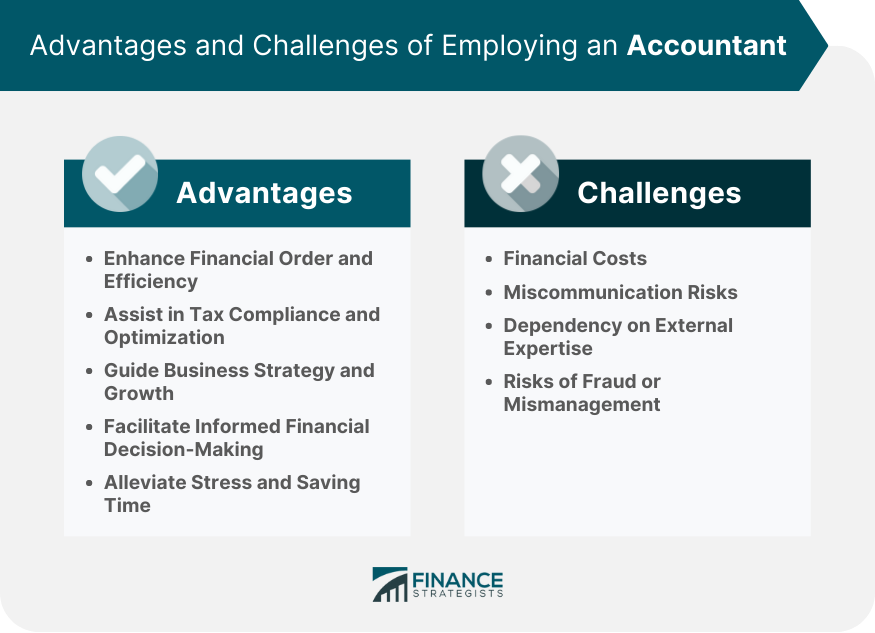

As soon as you have a handful of alternatives for a small company accounting professional, bring them in for quick meetings. http://prsync.com/pvm-accounting/. Local business owner have numerous various other responsibilities geared in the direction of expansion and development and do not have the moment to handle their finances. If you have a small company, you are likely to handle public or personal accounting professionals, that can be hired for an in-house solution or contracted out from a book-keeping firmAs you can see, accountants can assist you out throughout every phase of your firm's development. That doesn't indicate you need to employ one, yet the right accountant must make life less complicated for you, so you can focus on what you like doing. A certified public accountant can help in tax obligations while likewise providing clients with non-tax services such as bookkeeping and economic recommending.

The smart Trick of Pvm Accounting That Nobody is Talking About

One more major drawback to accounting professionals is their inclination for error. Employing an accountant lowers the possibility of filing imprecise documentation, it does not totally eliminate the possibility of human mistake impacting the tax obligation return. An individual accountant can aid you prepare your retirement and additionally withdrawl. They can help you handle your sequence of returns risk to make certain that you don't lack money.

This will certainly assist you produce a business strategy that's practical, specialist and a lot more likely to succeed. An accounting professional is a specialist who oversees the economic health and wellness of your business, day in and day out. Every local business owner must take into consideration employing an accounting professional before they in fact require one. Additionally, individual accountants enable their customers to preserve time.

About Pvm Accounting

They'll additionally likely come with a valuable expert network, as well as knowledge from the successes and failures of businesses like your own. Working With a State-licensed Accountant who understands https://turbo-tax.org/why-you-should-hire-an-accountant-for-your/ fixed asset accountancy can properly value your realty while remaining on top of variables that affect the numbers as time goes on.

Your accounting professional will certainly also provide you a feeling of essential startup expenses and financial investments and can show you how to keep working also in periods of decreased or adverse cash money circulation. - https://www.reddit.com/user/pvmaccount1ng/

Pvm Accounting Fundamentals Explained

Filing taxes and handling financial resources can be specifically testing for tiny business owners, as it requires understanding of tax codes and financial guidelines. A Qualified Public Accounting Professional (CERTIFIED PUBLIC ACCOUNTANT) can give invaluable assistance to little business proprietors and help them browse the intricate globe of financing.

: When it pertains to bookkeeping, accounting, and financial planning, a certified public accountant has the knowledge and experience to help you make informed choices. This know-how can conserve small company proprietors both time and cash, as they can rely upon the CPA's expertise to guarantee they are making the very best financial selections for their organization.

Not known Incorrect Statements About Pvm Accounting

CPAs are educated to stay current with tax regulations and can prepare precise and timely tax obligation returns. This can save small company proprietors from headaches down the line and guarantee they do not face any kind of fines or fines.: A CPA can also assist local business owners with economic planning, which entails budgeting and forecasting for future development.

: A CPA can likewise give important understanding and analysis for little organization owners. They can help determine areas where the organization is thriving and areas that need enhancement. Armed with this info, small company click for source owners can make modifications to their procedures to optimize their profits.: Lastly, employing a certified public accountant can provide local business proprietors with peace of mind.

Little Known Facts About Pvm Accounting.

Doing taxes is every obedient resident's responsibility. Besides, the federal government will not have the funds to give the solutions most of us rely upon without our taxes. Because of this, everybody is motivated to organize their taxes prior to the due day to ensure they prevent fines. It's additionally advised due to the fact that you obtain rewards, such as returns.

The dimension of your tax obligation return depends upon numerous elements, including your income, deductions, and credits. Consequently, working with an accounting professional is suggested due to the fact that they can see every little thing to ensure you obtain the optimum amount of money. Regardless of this, lots of people reject to do so since they think it's absolutely nothing even more than an unnecessary expenditure.

Pvm Accounting Can Be Fun For Everyone

When you work with an accountant, they can assist you avoid these mistakes and ensure you obtain the most cash back from your tax return. They have the expertise and competence to recognize what you're eligible for and exactly how to obtain the most money back - construction accounting. Tax period is frequently a difficult time for any type of taxpayer, and for a great reason